New report assesses economic impact of IMO’s candidate GHG reduction measures on Nigeria’s shipping and trade

7 days ago

4 min read

London, UK – 07.04.2025 – A comprehensive new report titled, "Impact Assessment of the IMO basket of candidate mid-term GHG reduction measures: The Nigeria Case Study," offers critical insights into the potential economic consequences of the International Maritime Organization’s (IMO) candidate mid-term measures on Nigeria's key trade sectors. The study, undertaken by researchers from the University of Lagos, Nigeria, and University College London (UCL), as part of the Leading Effective Afro-centric Participation (LEAP) Project, analyses the vessel-side, cargo-side, and combined cost impacts of various ship speed reduction scenarios and IMO policy options on Nigeria's major traded commodities.

The report highlights that achieving the IMO’s candidate mid-term measures will present compliance cost challenges for Nigeria, particularly when considering the combined impact on both vessel operations and cargo transportation. The analysis focuses on crucial commodities including crude oil and sesamum seed exports, as well as imports of petroleum motor spirit (PMS) and herbicides.

Dr Foluso Agunbiade, Associate Professor of Industrial and Sustainable Chemistry, University of Lagos, Nigeria, said “with an average combined cost increase of 4% on Crude Oil exports and Petroleum Motor Spirit (PMS) imports; 6% for agricultural goods, and up to 10% for herbicide imports, the IMO GHG Strategy will impact Nigeria’s trade. Thus, appropriate revenue generation and distribution mechanisms with emphasis on disbursement that will promote capacity building, research and development, technology acquisition for production of scalable zero emission fuels within developing countries with production potentials may reverse the impact and should be the equitable and just transition option for Africa.”

The report finds that vessel-side costs are a significant contributor to overall cost increases across various commodities, influenced by factors such as carbon pricing, the adoption of more expensive fuels, and necessary onboard investments. Cargo-side cost increases are generally lower, except for perishable goods where longer travel times due to speed reductions can lead to increased depreciation. For instance, sesamum seed exports, a perishable agricultural product, show a more pronounced increase in cargo costs with speed reduction compared to crude oil.

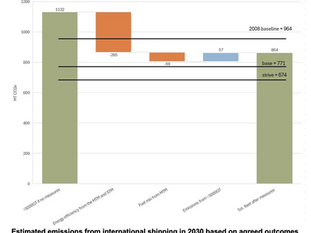

Across the modelled policy scenarios, the ‘Low Levy - Scenario 32’ was identified as a potentially advantageous option for Nigeria in both the short and long term for all modelled commodities, generally resulting in lower overall cost increases compared to other scenarios. By 2050, the estimated combined cost impacts across all speed reduction scenarios could reach approximately 4% for crude oil exports and PMS imports, and up to 10% for herbicide imports under a 30% speed reduction.

Chinonso Clare Ofodile, Development Economist & Trade and the Environment specialist said: "The LEAP Nigeria case study shows that maritime transport and logistics costs could rise by up to nearly 11%, with the highest impacts in GFI flexibility-only scenarios without revenue disbursement, posing real risks to Nigeria’s trade competitiveness. As maritime transport moves about 80% of global trade, and developing countries account for 70% of this by volume, the stakes are high. The analysis highlights how technical and economic measures will differently affect imports and exports, demanding context-specific responses. For African economies where trade drives macroeconomic stability, this is not just about ships and emissions; it’s about livelihoods, global value chain integration, economic resilience and balancing the needs of our nations and our planet in a just and equitable manner."

The analysis suggests that increased shipping costs over time could lead to higher export and import prices, reduced global competitiveness, lower trade volumes, and increased consumer prices, potentially impacting Nigeria’s GDP and broader trade competitiveness. The extent of these effects is contingent on the persistence of negative impacts and the interventions within each Scenario, such as levy requirements and the inclusion of revenue disbursement mechanisms.

The report underscores the importance of strategic and evidence-based interventions to mitigate these challenges and ensure a just and equitable decarbonization of international shipping, preventing African states from being left behind in the global energy transition.

Dr Dola Oluteye, Senior Research Fellow at UCL Energy Institute Shipping and Oceans Research Group said: “This case study underscores the urgent need for strategic engagement to ensure that climate action does not come at a disproportionate cost to Africa’s development. While the decarbonisation of international shipping is essential, our findings show that, without careful management, it could deepen existing trade and economic inequalities for countries like Nigeria. A robust policy framework must include targeted mitigation measures, coordinated global action, and equitable revenue redistribution. Nigeria’s high dependence on raw material exports, particularly petroleum products, and manufactured imports makes it especially vulnerable to rising maritime logistics costs, with potential consequences including reduced competitiveness, falling export volumes, and import-driven inflation.”

The study emphasises that understanding these potential economic impacts is crucial for informing policy decisions in Nigeria and ensuring that the principles of justice and equity are upheld as the maritime industry transitions to zero and near-zero emission fuels. The findings also highlight the interconnectedness of maritime trade with other sectors, including energy, agriculture, and manufacturing, stressing the need for a holistic approach to managing the transition.